Focus only on the quality trade execution

When a trader learns about trading for the first time, his or her mind may be dazzled. Due to a lot of ideas, strategies, and plans, the trading business seems difficult for the rookie traders. In the case of currency trading, many rookie traders feel even worse when they learn about the industry. If you want to trade in Forex and to make a profit, your trading edge must be on par with the highest quality. At the same time, you must also have the best possible money management plan for the trades. If you can establish an efficient trading edge for your business, it will increase your profit potential. At the same time, you must also try to improve your market analysis skills because to gain profit potentials from the trades, every trader in Hong Kong must position the trades precisely. Therefore, they will need to handle the trades with efficient policies.

All things aside, a trader must have the best sense of the important aspects of a trading approach. For that, they need to keep their mind clean with little to almost no tension about the business. If you can manage a decent profit potential from the trades and secure the investment, the business will reach a reputed state where you do not need to worry about losing money. All these things apart, a trader needs to improve his or her trading edge. For that, he or she needs to implement comfortable preferences.

Choose a suitable trading method

The first comfort factor should come from the Forex trading method. If you want to perform efficiently in the business, your trading edge must have the best possible trade setups. But, the rookie traders also prefer a certain profit potential. For different individuals, the profit target remains different. If you want to trade for too big profit margin, the trades must follow a long timeframe. Using swing and position trading method will provide you the opportunity. At the same time, you must also have the ability to improve your trading edge for a decent performance with a longer timeframe.

For those who are comfortable with short timeframe trades, the scalping or day trading is suitable for those traders. Those systems may not provide the relaxation you want but, there is a chance of consistent income from short term trading methods. But you must have the ability to secure the trading business with consistent plans.

Develop your trading edge properly

There are a lot of things required for the trading business in Forex. First of all, the money management plan will be needed for the management of the trading money. At the same time, you will also need to develop a solid market analysis skills to predict the volatility. Besides, it is also needed for timing the trades precisely for the trades. If you want to manage a decent trading performance, it is important to secure the capital first and then aim for a decent profit margin. Aside from the market analysis and money management, there are some other things to use for the trades.

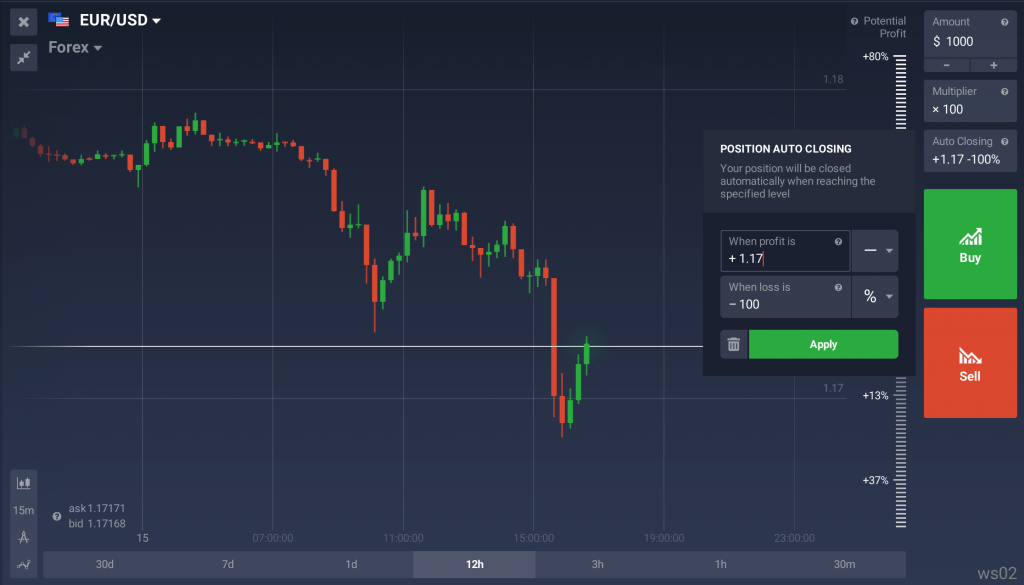

You must secure the trades with a decent positioning system. Based on a preferred risk to reward ratio, try to find a valuable trade setup. And after finding one, execute a trade with appropriate tools like stop-loss and take-profit. It will help you secure the capital with a decent profit margin.

Concentrate on the important aspects

If you want to manage a decent trading performance in the forex marketplace, focus on every important aspect of trading. Do not worry too much about the loss and use appropriate tools and strategies to stay safe. Then, you will have less tension about placing a trade. At the same time, you can also focus on the market analysis for a valuable position sizing. Thus, you can easily gain a decent profit margin from the trades. So, try to improve your plans with pro-level strategies.